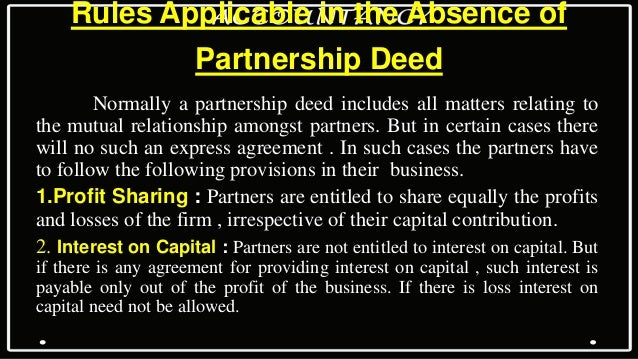

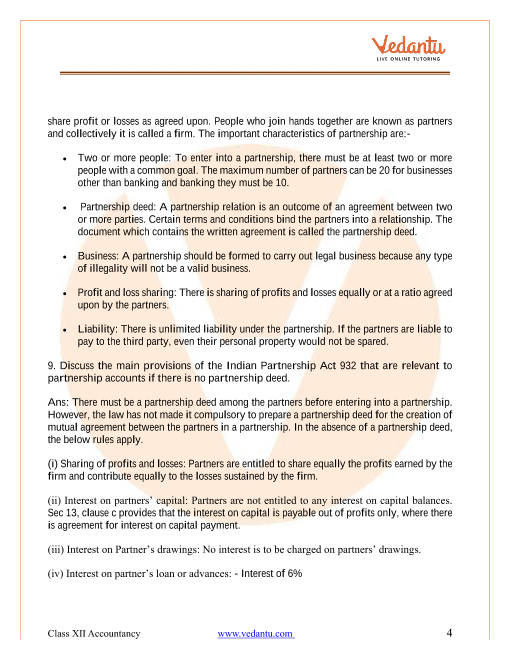

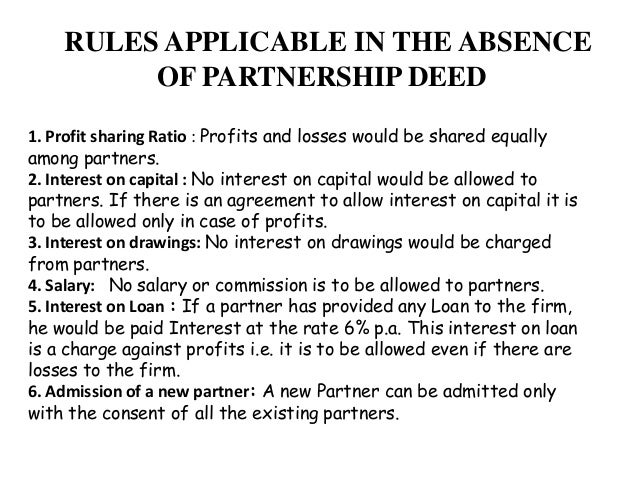

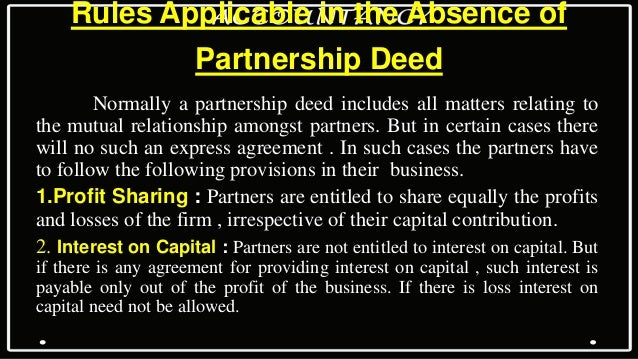

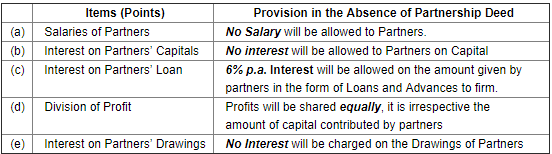

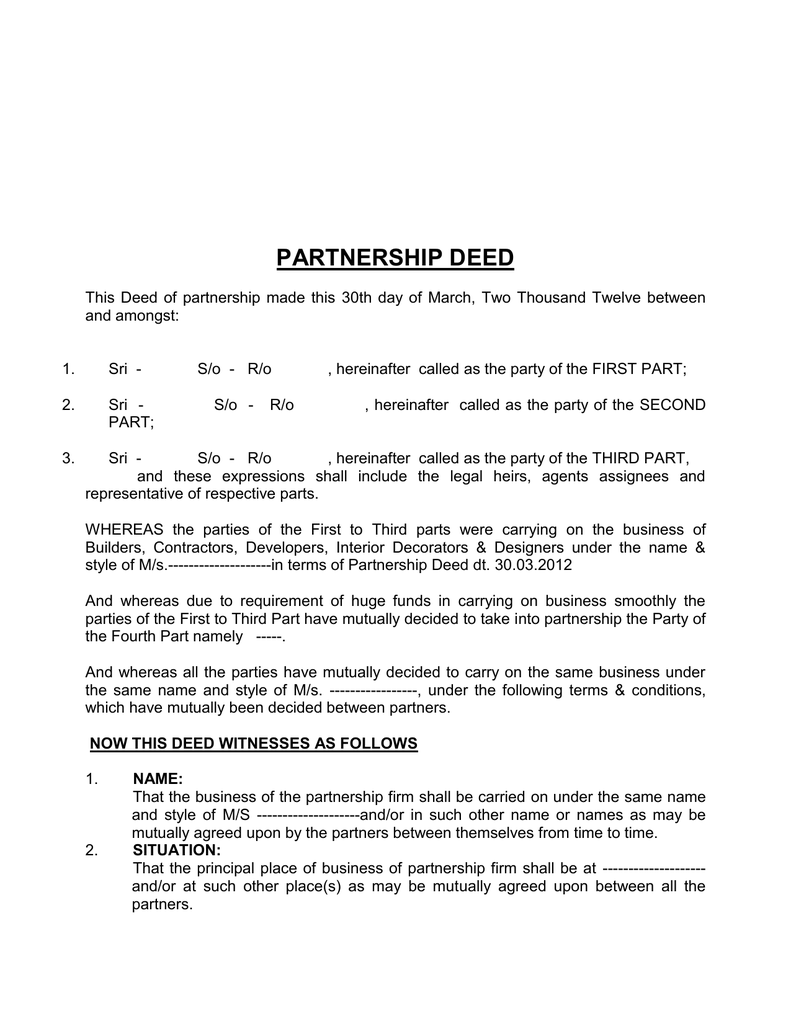

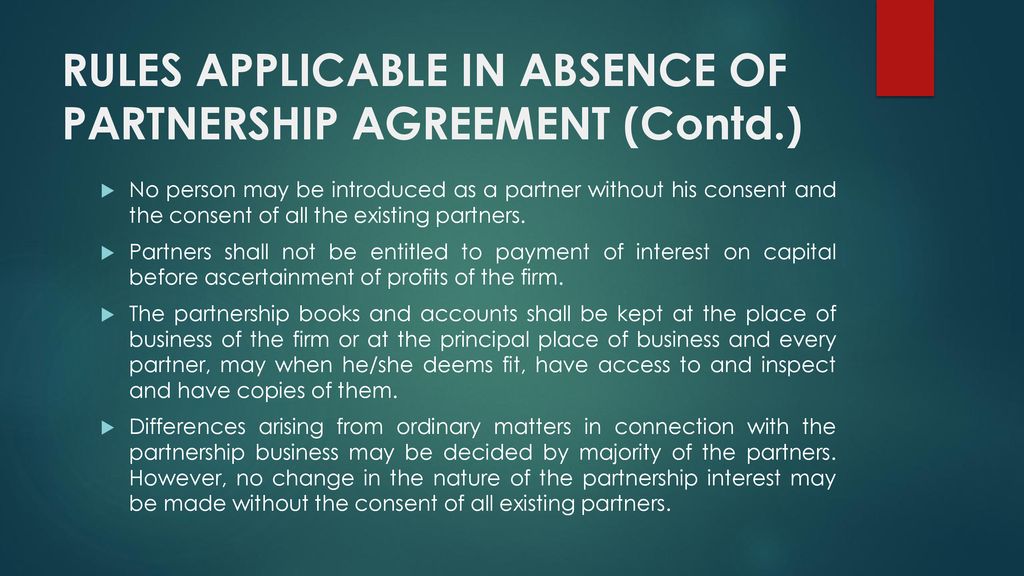

In the absence of a Partnership Deed, the provisions of the Partnership Act apply RULES /PRINCIPLES APPLICABLE IN THE ABSENCE OF A PARTNERSHIP DEED The rules applicable are contained in Section 28 and 29 of the Partnership Act 1 Profit and loss are shared equally 2 If a partner incurs liability while discharging the firm's obligations heAnswer In case of partnership deed is silent then section 2 of the Partnership Act 1932 will apply according to the Section partners are not provided with remuneration it is clearly mentioned that unless there is an agreement between the partners toRegistration of Partnership Deed All the rights and responsibilities of each member are recorded in a document known as a Partnership Deed This deed can be oral or written;

My Ox7nqi6vujm

In the absence of partnership deed what are the rules relating to

In the absence of partnership deed what are the rules relating to-In the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to interest on their capital 3 No partner will be allowed salary, or any other remuneration for any extra work done for the firm Oct 11,21 In the absence of any deed of partnershipa)Only working partners are entitled to Salaryb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Interest at the rate of 6% is to be allowed on a partner's loan to the firmCorrect answer is option 'D'

Accounting For Partnership Firms Fundamentals

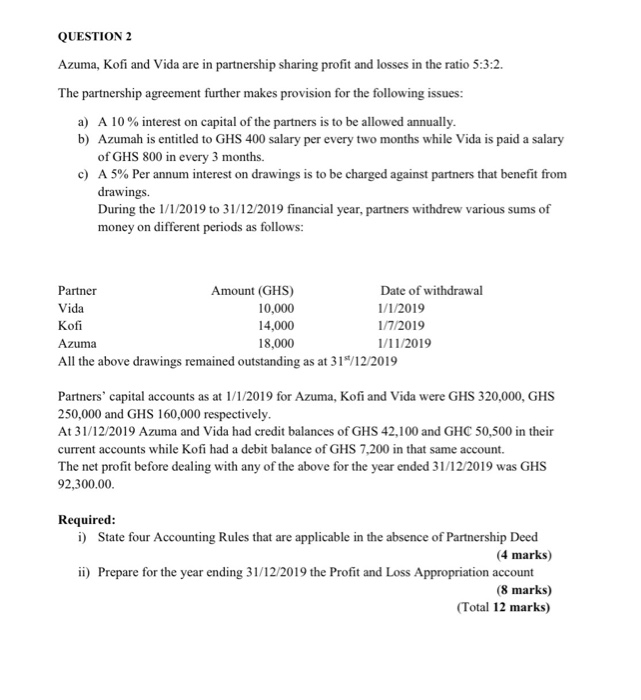

Click here 👆 to get an answer to your question ️ Q6 In the absence of Partnership Deed, What are the rules relating toa) Salaries of Partnersb) Interest on provision in the absence of partnership deed (a) salaries to partners No salary will be allowed to partners (b) Interest on partners No interest will be allowed to partners on their capital (c) Interest on partner loan 6% pa interest will be allowed on the money given by parters to the firm in the form of loans and advances (d) Distribution of profitSolution Question 2

Thanks for 100 Subscribers and expecting much moreEnjoy online LearningIn the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capitalIn the absence of partnership deed , what are the rules relating to also give Ask questions, doubts, problems and we will help you

General rule for liabilities is borne equally by all partners unless an agreement contrary to it exists between all partners In absence of partnership deed the scope of anything else but equal shared gains and liabilities will followed in the bus Relevant Statute in the absence of Partnership Deed Following are some of the rules applicable to all the partners if the partnership deed is not prepared Proportionate allocation of profits No interest on capital is provided to any partner No interest on drawings is given No salary or commission is granted Interest on loan arranged by a partner will be given @If partnership deed is silent about it, then the partners shall have rights and obligations mentioned in the Partnership Act Right of a Partner (i) Every partner has a right to take part in the conduct and management of the business (ii) Every partner has a right to be consulted before taking important decisions The decisions should be taken by mutual consent If the decisions are

Partnership Deed

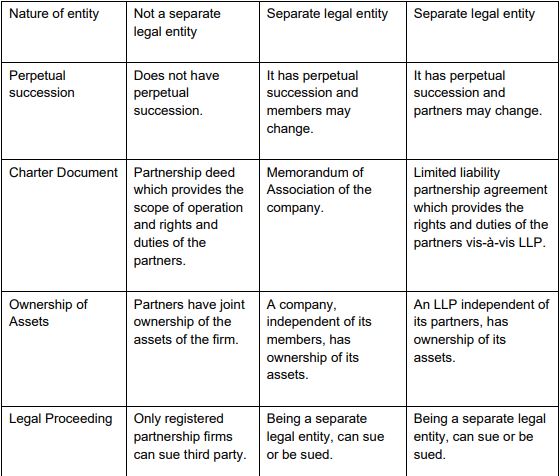

Faqs On Limited Liability Partnership In India Lexology

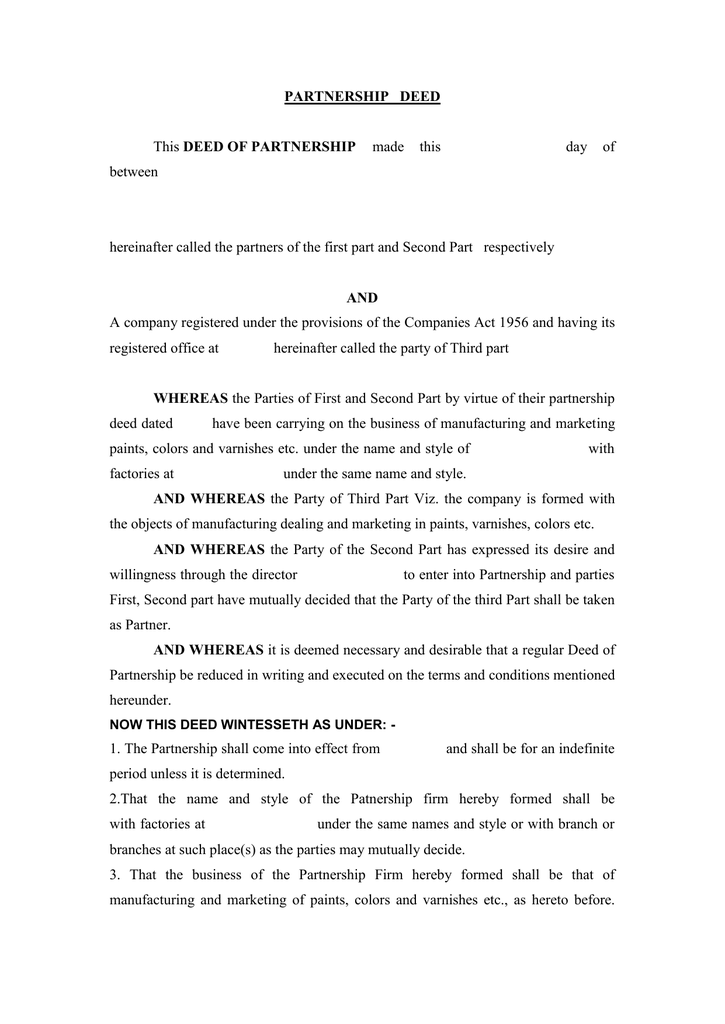

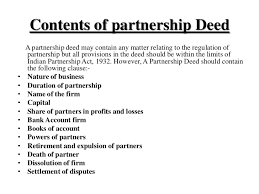

– A partnership agreement can be in oral or written form It is not mandatory to have a written agreement But to avoid any kind of misunderstanding among partners, it is always advisable to have a written partnership deed Content of Partnership Deed Related to the firm Name and address of the firm;In the absence of partnership Deed, what are the rules relating to (a) Salaries of partners, (b) Interest on partners' capitals, (c) Interest on partners loan, (d) Division of profit,Rules applicable in the absence of Partnership Deed Sharing of Profits – In the absence of any partnership deed, the profits among the partners should be shared equally Salary/commission to the partners The partners won't get any portion of

Accountancy 1 Pages 101 150 Flip Pdf Download Fliphtml5

Cbse Class 12 Lesson 2 Applicability Of Provisions In The Absence Of Partnership Deed In Hindi Offered By Unacademy

In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner RULES APPLICABLE IN THE ABSENCE OF PARTNERSHIP DEED As we know from the previous discusion that it is not cumpulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932The written agreement of partnership is most commonly referred to as

Rules Applicable In The Absence Of Partnership Deed Accountancy Class Xii Youtube

Rules Applicable In The Absence Of Partnership Deed Accountancy Class Xii Youtube

Rule to be followed at the time of settlement of outgoing partners Bank Account details;According to the Garner Vs Murray rule Capital deficiency of insolvent partner will have to borne by remaining solvent partner Tick the situations in which a partnership firm comes to an end;The type and nature of the business

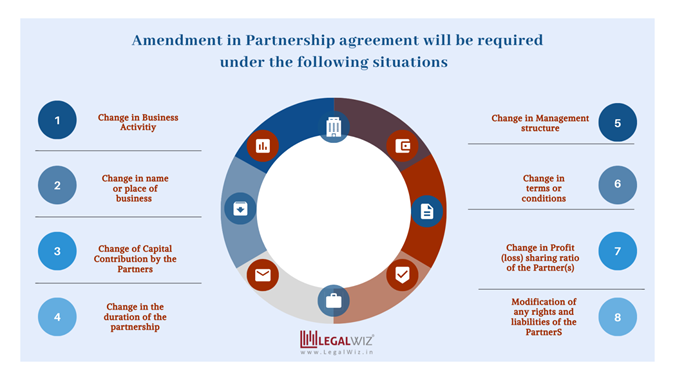

Change In Partnership Deed Know The Reasons And Procedure

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Accounting rules applicable in the absence of Partnership deed Normally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply forAbsence of a Partnership Deed The partners will share profits and losses equally Partners will not get a salary Interest on capital will not be payable Drawings will not be chargeable with interest Partners will get 6% pa interest on loans to the firm if they mutually agreeEduRev Commerce Question is disucussed on EduRev Study Group by 105 Commerce Students

Accounting Rules Applicable In The Absence Of Partnership Deed Archives Bhardwaj Accounting Academy

Class 12 Accounts Fundamental Of Accounts Notes

Sep 12,21 In absence of partnership deed, what are the accounting treatment Related 01 Introduction to Partnership Accounting Class 12 Accounts?On 1st June, 18 a partner introduced in the firm additional capital Rs 50,000 In the absence of partnership deed, on 31st March, 19 he will receive interest ATick the Provisions of Partnership Act, 1932 in the absence of Partnership Deed;

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts Www Cbs Learn Accounting Accounting Solutions

Partnership Deed By Dhanya V L

In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings 24 In the absence of agreement, partners are not entitled to (A) Salary (B) Commission Equal share in profit (D) Both (a) and (b) 25Click here👆to get an answer to your question ️ In the absence of partnership Deed, what are the rules relating to(a) Salaries of partners,(b) Interest on partners' capitals, (c) Interest on partners loan, (d) Division of profit, (e) Interest on partners' drawings? RULES APPLICABLE IN THE ABSENCE OF PARTNERSHIP DEED In the absence of partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, the following provisions of the Indian Partnership Act, 1932 will be applicable PROFIT SHARING RATIO Profits and losses are to be shared equally irrespective of their capital contribution

Rules Applicable In The Absence Of Partnership Deed Depkblog

Ts Grewal Solutions Class 12 Accountancy Accounting Partnership Firms Fundamentals Accounting Fundamental Solutions

👍 Correct answer to the question In the absence of deed, specify the rules relating to the following (i) sharing of profits and losses (ii) interest on partner's capital (iii) interest on partner's drawings (iv) interest on partn eanswersinHowever, an oral agreement is of no use when the firm has to deal with tax A few essential characteristics of a partnership deed are The name of the firmIn the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

2

2)no interest on drawings is given to partners of the firm 3) also no interest on capital is given to the partners 4) profits and losses are shared equally among the partners 5) no remuneration ie salary is given to the partners In the absence of partnership deed the profits of a firm are divided among the partners (a) In the ratio of capital (b) Equally (c) In the ratio of time devoted for the firm's business (d) According to the managerial abilities of the partners (b) Equally According to partnership act 1932, in the absence of any partnership deed, profits of the firm are divided among the In the absence of a partnership deed, the under mentioned provisions of the Partnership Act, 1932 will be applicable (1) Profit and losses are to be shared equally (2) No interest is to be allowed on capitals

Partnership Deed Agreement Of Firm 15 Contents Format Types

Nta Ugc Net Hindi Partnership Accounts For Ugc Net By Unacademy

In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on partner's drawings (iv) Interest on partner's loan (v) Salary to a partner Answer(i)Sharing of Profit and Losses In the absence of partnership deed profit sharing ratio among the pad maw will be equal (ii) Interest What rules of partnership apply in the absence of partnership deed?In the absence of Partnership Deed AInterest will not be charged on partner's drawings,BInterest will be charged @ 5% pa on partner's drawings,CInterest will be charged @ 6% pa on partner's drawings,DInterest will be charged @ 12% pa on partner's drawings

Punainternationalschool Com

Accounting Rules Applicable In The Absence Of Partnership Deed Archives Bhardwaj Accounting Academy

The document which contains terms and conditions of partnership is known as Partnership Deed In the absence of an agreement, the partnership Act is applied, However, the act leaves it to the discretion of partners The written agreement between partners will be helpful in case of disputes between the partners Important Points of a Partnership Deed The A and B were sharing profits of a business in the ratio of 3 2 They admit C into partnership, who gets 1/3 of A's share of profit from A, 1/2 of B's share of profit from B The new profit sharing ratio will be– 8 In the absence of a Partnership Deed, the rate of interest allowed on the partner's loan to the firm is– 9 Partnership Deed is a document containing the terms and conditions of a partnership business It is an agreement in writing signed by all the partners duly stamped and registered It defines the rights, duties, and obligations of partners The partnership deed must not contain any term which is contrary to the provisions of The Indian

Vsajaipur Com

Partnership Deed Contents Features Benefits All You Must Know

The partnership deed must be made on stamp paper and every partner must have a copy of the partnership deed A copy of the partnership deed must also be filed with the Registrar of Firms if the firm is being registered Absence of a Partnership Deed If no partnership deed is created, the following rules apply The partners have an equal shareArticle shared by In the absence of partnership deed the following rules regarding rights and duties are followed Regarding rights Every partner hasIn the absence of Partnership Deed, what are the rules relating to (a) Salaries of partners, (b) Interest on partners' capitals, (c) Interest on loan by partner, (d) Division of profit, (e) Interest on partners' drawings

My Ox7nqi6vujm

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

The partnership deed determines the general administration of the partnership like what will be the profitsharing ratio, who will do what work etc The partnership contains the rights and duties of the partners Such a deed can be made either expressly or by necessary implication For example, if one partner looks into sales daily and otherTS Grewal Solutions for Class 12 Accountancy – Accounting for Partnership Firms Fundamentals (Volume I) Question 1 In the absence of Partnership Deed, what are the rules relating to a Salaries of partners, b Interest on partner's capitals, c Interest on partner's loan, d Division of profit, and e Interest on partners' drawings?RULES IN THE ABSENCE OF PARTNERSHIP DEEDHELLO DEAR FRIENDS !Greetings of the dayI am Sahil Roy and I welcome you to my Channel Aucommerce ScholarIn

Accounts Pdf Dividend Revenue

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

In the absence of Partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner

2

What Rules Of Partnership Apply In The Absence Of Partnership Deed

Partnership Deed Accounts Class 12 Arinjay Academy

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Day 5 Class 12th Commerce Rules Applicable In The Absence Of Partnership Deed Youtube

2

2

Nanopdf Com

Ncert Solutions For Class 12 Accountancy Chapter 2 Accounting For Partnership

Free Domestic Partnership Agreement Free To Sign Download

What Is The Role Of A Partnership Deed In An Organization Quora

Rules Applicable In The Absence Of Partnership Deed Depkblog

2

Plus Two Accountancy Part 1 Text Book Pdf Pages 101 150 Flip Pdf Download Fliphtml5

A Partnership Deed Its Usage And Its Execution Legal News Law News Articles Free Legal Helpline Legal Tips Legal India

2

Indian Partnership Act

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts Accounting Accounting And Finance Fundamental

Free Partnership Agreement Create Download And Print Lawdepot Us

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

13 Partnership Fundamental Rules Applicable In The Absence Of Partnership Deed Youtube

Partnership Deed Commerceiets

Provisions In The Absence Of Partnership Deed Special Provisions Of Partnership Act 1932 Hindi Youtube

Rohan Acs Ppt

Rules Applicable In The Absence Of Partnership Deed Accountancy Class Xii Youtube

Question 2 Azuma Kofi And Vida Are In Partnership Chegg Com

Reconstitution Of Partnership Deed

State The Provisions Of Partnership Act 1932 In Absence Of Partnership Deed Regarding 1 Interest On Partners Drawings And 2 Interest On Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Accounting For Partnership Firms Fundamentals

Question 1 Chapter 2 Of 2 A T S Grewal 12 Class Part A Vol 1

Rules Applicable In Absence Of Partnership Deed Youtube

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

2

Rules Applicable In The Absence Of Partnership Deed Youtube

Solved If The Partnership Deed Is Absent Specify The Rules Relating To 1 Answer Transtutors

2

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals

Partnership Deed Corporate Experts

Rules Applicable In The Absence Of Partnership Deed Youtube

2

Ch 1 3 Rules Applicable In The Absence Of Partnership Deed Youtube

Department Of Accounting And Finance Course Code Acc Ppt Download

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/creative-coworkers-standing-up-looking-at-laptop-493816423-5ba1651846e0fb0025b460b7.jpg)

What Should I Include In A Partnership Agreement

Partnership Rules Faqs Findlaw

Partnership Deed Meaning Format Registration Stamp Duty

Rohan Acs Ppt

Xii 2 3 Rules Applicable In The Absence Of Partnership Deed പ ര ട ട ണര ഷ പ പ Partnership Youtube

Cbse Class 12 Rules In The Absence Of Partnership Deed And Profit And Loss Appropriation Account Offered By Unacademy

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

In The Absence Of Partnership Deed What Are The Rules Relation To A Salaries Of Partners B Brainly In

2

All You Need To Know About The Indian Partnership Act 1932

Partnership Deed Meaning Format Registration Stamp Duty

Basic Concept Sole Proprietorship Business Forms Of Business Partnership Joint Hindu Family Business Cooperative Society Company Ppt Download

Indian Partnership Act 1936

Partnership Deeds Meaning Contents With Solved Questions

Rules Applicable In The Absence Of Partnership Deed Youtube

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

5

Execution Of Documents Top Ten Q As Stevens Bolton Llp

2

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Rules Applicable In The Absence Of Partnership Deed Youtube

Cbse Class 12 Rules In The Absence Of Partnership Deed And Profit And Loss Appropriation Account Offered By Unacademy

Deed Of Partnership

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Rules Applicable In The Absence Of Partnership Deed Youtube

2

Partnership Deed And Discuss Its Contents

Harividyabhawan Com

Accounts14

Importance

Nta Ugc Net Meaning And Contents Of Partnership Deed And Rules In The Absence Of Partnership Deed In Hindi Offered By Unacademy

0 件のコメント:

コメントを投稿